Health insurance in Houston is one of the most important matters of consideration for residents of the city. With a population of over two million people, the need to ensure access to quality healthcare is paramount. Health insurance is the primary vehicle to guarantee that residents of Houston have access to the care they need.

Understanding health insurance in Houston is a complex issue, and one that requires an in-depth look into the many options available to residents. There are multiple insurers serving the city, each with their own plans and coverage levels. Additionally, the city’s public health facilities offer a variety of resources and services. It is important to take the time to fully understand the various options available to Houstonians so as to make an informed decision when selecting a health insurance plan.

Types of Health Insurance in Houston

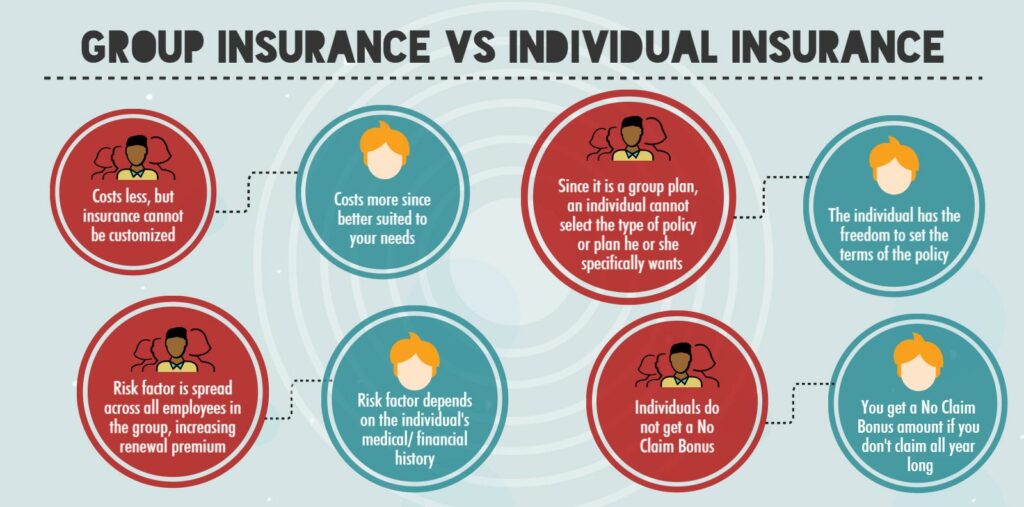

Health Insurance in Houston offers a variety of options for individuals, families, and groups. Individuals can opt for a plan that caters to their specific needs, while group plans could be advantageous for businesses. Medicare and the Affordable Care Act provide added coverage for those who qualify. High Deductible Health Plans are an option for those looking for coverage but also want a low monthly premium. All of these plans are available in Houston, allowing Texans to choose the best plan for them and their families.

1 . Individual Plans

Individual health insurance plans in Houston are designed to provide coverage for those who do not have access to traditional group health insurance plans, such as those offered by employers. These plans are available to a wide range of people, including the self-employed, those who are unemployed, and those who are retired. Premiums can be based on the age, gender, and health status of the individual, and premiums can range from very economical to quite expensive depending on the specific plan chosen.

Coverage options for individual health insurance plans are vast and can include preventive care, hospitalizations, doctor visits, prescription drugs, and more. Many health insurance plans in Houston also include coverage for vision and dental care, as well as mental health care. Depending on the plan, some additional out-of-pocket costs may be required, such as deductibles and coinsurance.

It is important to note that individual health insurance plans in Houston may not cover pre-existing conditions, although some plans may be willing to offer limited coverage.

2 . Group Plans

Group health insurance plans are a popular option for businesses in Houston, offering employees the opportunity to access quality health care at reduced costs. Employees can select from a variety of plans, from basic coverage to comprehensive coverage. Group plans are often lower in cost than individual plans, as the risk is spread out amongst a larger pool of people. Furthermore, many group plans offer additional discounts and benefits to members that are not available to individuals.

In Houston, group health insurance plans are structured to meet the needs of employers and employees alike. Often, employers will pay for a portion of the health insurance premiums for their employees, allowing them to access health care services at a more affordable rate. Additionally, group plans often offer additional coverage such as vision and dental, as well as prescription drug coverage.

Group health insurance plans are an ideal option for businesses in Houston, as they provide employees with access to quality health care at affordable rates. Furthermore, employers can benefit from reduced costs and additional coverage options for their employees.

3 . Medicare

The golden glow of Medicare envelops many of the elderly and disabled citizens in Houston. This federal health insurance program is the lifeblood of those who are 65 years and older, as well as those with certain disabilities. Many of Houston’s citizens have come to rely on this form of health insurance, which provides a wealth of coverage options, including hospital bills, doctor visits, and prescription drugs. Additionally, insurance can be used to cover the costs associated with medical equipment and care in the home. In order to be eligible for Medicare, an individual must be 65 years old or have a qualifying disability. As part of the Affordable Care Act, there are also additional options for those who qualify. With Medicare, Houston’s citizens are able to receive the health care they need, and the peace of mind that comes with it.

Understanding Your Options

Understanding Your Options for Health Insurance in Houston is paramount to making the best choice for you and your family. In order to make an informed decision, you must understand the terms associated with health insurance such as Deductible, Cost Sharing, Benefits, and Enrollment Process. A deductible is the amount you must pay out-of-pocket before your insurance plan begins to cover your medical expenses. Cost Sharing typically involves coinsurance or copayments and are your required payments for covered services. It is important to understand the benefits of each plan and how they are applied.

1 . Deductible

With a renewed sense of importance, it’s time to start exploring the different options of health insurance in Houston. One of the most important elements to consider when choosing a health insurance plan is the deductible. A deductible is the amount of money that you have to pay for medical care before your insurance company will start to cover the cost. For example, if your plan has a deductible of $2,000 then you will be responsible for all medical expenses up to $2,000 before the insurance company will begin to pay for your care. Deductibles vary widely and may be higher or lower depending on the plan you choose. It’s important to consider the deductible when selecting a plan that works best for you and your family.

2 . Cost Sharing

The intricacies of health insurance in Houston can be overwhelming, especially when it comes to understanding the costs associated with it. Cost sharing is an essential component of health insurance that you should be aware of when making decisions about your coverage.

Cost sharing is the portion of medical costs that you are responsible for paying out-of-pocket. This includes deductibles, copayments, and coinsurance. Deductibles are the amount of money you must pay for medical services before your health insurance will start to pay. Copayments are set amounts that you pay at the time of service, such as a $20 fee for a doctor’s office visit. Coinsurance is a percentage of the cost of a service that you must pay, such as a 20% co-insurance for a lab test.

Cost sharing can vary greatly depending on the type of health insurance you have. For instance, if you have an HMO plan, you may not have to pay any out-of-pocket costs for certain services.

3 . Benefits

The range of benefits offered by health insurance in Houston varies greatly. From preventive care, to doctor visits, to hospitalization, to prescription drugs, there is something for everyone. Even dental and vision care are available in some plans. Additionally, plans may offer coverage for treatment of mental health issues, substance abuse, and even alternative therapies.

Moreover, plans may also provide coverage for preventive care such as routine immunizations and health screenings, as well as provide additional financial assistance for women’s health care services and maternity services. Many plans also offer coverage for preventative care such as immunizations and screenings, as well as discounts for certain services.

Health insurance in Houston can also provide coverage for a wide range of medical services, such as lab tests and X-rays, as well as outpatient care and hospitalization. In some cases, plans also cover emergency services, including ambulance and air ambulance services. Furthermore, some plans may also cover services such as physical therapy, occupational therapy, and speech therapy.

Comparing Plans

Comparing health insurance plans in Houston can be a daunting task. Price, coverage, and network are all important factors and must be taken into consideration. When comparing plans, it’s important to look at the premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. Additionally, it’s critical to make sure the plan is accepted by your doctor. Lastly, it’s important to research the network to make sure it meets your needs. With these factors in mind, finding the best affordable plan is possible. Time is valuable, so use these tips to make the process of comparing plans easier and faster.

1 . Price

Price is a major factor when it comes to choosing health insurance in Houston. Premiums can vary greatly between plans, and it is important to understand what is included in the cost that you pay each month. Generally, the more comprehensive the coverage, the more expensive the plan. Additionally, if the plan has a high deductible, then the premiums may be lower than those that have a lower deductible. When comparing plan prices, it is important to consider the total cost for a year, not just the monthly premiums, as this will give you a better idea of what you will ultimately be paying. Factors such as deductibles, copays, coinsurance, and out-of-pocket maximums should also be taken into account to make sure you get the best value for your money.

2 . Coverage

Now that you have a basic understanding of the different types of health insurance plans, it is time to compare plans to find the best option for you. One of the most important aspects to consider when comparing plans is coverage. Health insurance coverage is the amount of medical services that the plan will pay for. Generally, coverage is broken down into two categories: preventive care and medical care.

Preventive care includes services like check-ups, vaccinations, health screenings, and counseling. Medical care covers treatments for illnesses or injuries, surgeries, and hospitalizations. It is important to evaluate the types of services that the plan covers for both preventive and medical care. Additionally, you should verify if there are any copays, deductibles, or coinsurance for services you may need.

Some plans may offer more coverage for preventive care, while others may provide more coverage for medical care. You should carefully consider the types of coverage each plan offers and your medical needs before making a decision.

3 . Network

Now that you have a better understanding of the different health insurance plans available in Houston, it’s time to compare them. One of the most important aspects to consider when comparing plans is the network. A health insurance network is made up of healthcare providers, such as hospitals, doctors, pharmacies, and mental health professionals, who have a contract with the insurance company to provide services to the plan’s members. Therefore, it’s important to check the health insurance plan’s network to ensure that it includes the providers you need.

The size and type of network can vary widely depending on your plan. Some plans are considered HMOs, which are more restrictive but often less expensive. Other plans are PPOs, which offer more flexibility but are typically more expensive. Additionally, some networks may include out-of-network providers as well, meaning that they are not contracted by the insurance company but may still be covered for certain services.

Finding the Right Plan

Finding the right health insurance plan in Houston requires research, comparison and understanding of deductibles and co-pays. Starting by researching different plans available in the area, looking at what is covered and what is not, and comparing quotes can be a daunting task. However, it’s important to make sure to understand the deductibles and co-pays for the plan before enrolling in it. Deductibles refer to the amount of money that must be paid for before the insurance company pays costs and co-pays are the amount the insured must pay for services.

1 . Research

Having completed the comparison of plans, it is now time to begin the research phase. The research process starts with understanding the basics of health insurance in Houston. One must become familiar with the various types of plans available, such as HMOs, PPOs, and POS plans, each of which has its own set of rules and regulations. Additionally, research should be conducted into the various insurance providers in the Houston area, as well as the coverage and cost associated with the different plans.

Once the basics of health insurance in Houston have been understood, it is time to begin comparing quotes. By comparing quotes from different providers, individuals can find the plan that best meets their needs and budget. Additionally, it is important to understand the difference between deductibles and co-pays, as these two items are often confused. Deductibles are the initial amount of money an individual must pay before their insurance kicks in, while co-pays are the amount of money an individual must pay for a particular service.

2 . Compare Quotes

The search for the right health insurance plan becomes clear after taking the time to compare quotes. To ensure the best coverage fit for an individual or family, it is important to research the different plans available in Houston. By researching everything from deductibles to co-pays for each plan, the process of finding the right health insurance plan can begin.

Comparing quotes helps to get the most comprehensive plan for the best price. The comparison process should start with the basics, such as the monthly premium, deductibles, and co-pays. It is also important to review the benefits and coverage details to make sure the plan covers the needs of the individual or family. Whether it be medical, vision, or dental, the comparison of quotes should be in-depth.

Along with researching the details of the plan, comparing quotes should also include reviews from current or past customers. This can help to get a better understanding of the customer service of the health insurance provider and any issues that may have experienced by customers.

3 . Enroll

Having compared health insurance plans, the next step is to enroll. In Houston, the process of enrolling for health insurance is straightforward. Individuals can register online, over the phone, through a broker, or in-person.

It’s important to note that the enrollment period is limited and begins in November and ends in December for the upcoming year. During this period, individuals can choose from a variety of plans or update their existing coverage. To ensure the best coverage for the upcoming year, Houstonians should take the time to thoroughly research and compare health insurance plans and quotes.

Enrolling for health insurance in Houston can be done quickly and easily. Individuals can visit the healthcare.gov website and use the Health Insurance Marketplace to make their selection. They can also visit their local health insurance company’s website and view the available plans and coverage options.

Once enrolled, individuals can begin using their health insurance plan. Understanding the plan’s deductible and co-pay amount is essential to using the plan effectively.

Conclusion

Choosing the right health insurance plan can be a daunting task in Houston. With so many options to choose from, it can be difficult to understand what each plan offers and how different plans compare. It is important to take the time to explore your options and research the different plans to find the plan that best fits your needs. Making an informed decision about your health insurance will help ensure that you receive the coverage you need and the peace of mind that you’re getting the best value for your money.