As we approach the halfway point of the tax season, it’s worth taking a moment to reflect on what we’ve learned so far. The Internal Revenue Service (IRS) has reported that taxpayers are submitting their returns and getting them processed more quickly than in previous years. Here’s what we know:

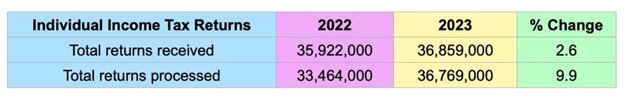

More Returns Filed and Processed

According to IRS data, the number of individual income tax returns received this year is 2.6% higher than the previous year. As of February 17, 2023, the IRS received 36,859,000 returns compared to 35,922,000 in 2022. Furthermore, the IRS processed 36,769,000 returns in 2023, an increase of 9.9% over the same period in 2022. This is likely a sign that the IRS has finally worked through its backlog.

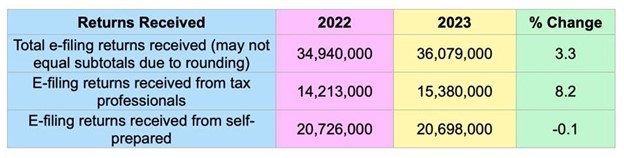

E-filing Continues to Dominate

Electronic filing remains the most popular way to file taxes, with 98% of tax returns received to date in 2023 being filed electronically. This is no surprise given the convenience and speed of e-filing.

Refunds Issued in Record Numbers

The IRS has issued 27,781,000 tax refunds so far this year, a significant increase of 25.9% over last year. However, the average tax refund per taxpayer is down by 11.2% compared to 2022, likely due to the lack of an enhanced child tax credit this year. Despite the decrease in the average tax refund, the overall amount of tax refund dollars has increased to $87.245 billion.

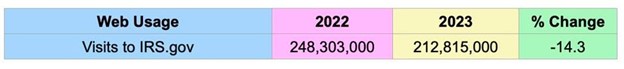

Web Visits to IRS.gov Down

Interestingly, web visits to IRS.gov are down 14.3% compared to the same period in 2022. This is likely due to the absence of complicated rules surrounding the expanded child tax credits and the recovery rebate credits. Without these factors in play this year, there may be less confusion and urgency.

What’s Next?

The two-week period following Presidents Day typically marks a switch in refunds, with the IRS beginning to issue refunds to taxpayers who claim the earned-income tax credit (EITC) and the additional child tax credit (ACTC) after Feb. 15, 2023. Additionally, this period historically sees a peak in IRS phone lines.

Conclusion

Overall, tax season is off to a positive start. With e-filing continuing to dominate, returns being processed more quickly, and record numbers of refunds being issued, taxpayers can expect a smoother tax season than in previous years. As always, it’s essential to stay up to date with the latest developments to ensure a successful tax filing.