Navigate the complexities of Obamacare Subsidies with our comprehensive guide. Learn about the Types of Financial Assistance available and the Eligibility Criteria to qualify. Understand the different Plan Types and Choices in the Health Insurance Marketplaces and how the Premium Tax Credit is Calculated. Discover the steps on How to Receive the Premium Tax Credit and be aware of Special Considerations and Exceptions that may apply to you. Finally, get quick answers to Frequently Asked Questions about Obamacare Subsidies.

1. The ACA and Health Insurance Marketplaces

The Affordable Care Act (ACA), commonly known as Obamacare, revolutionized healthcare in the United States by providing more Americans with access to affordable health insurance. One of the pivotal components of the ACA is the establishment of Health Insurance Marketplaces, also referred to as exchanges. These Marketplaces serve as online platforms where consumers can compare and purchase health insurance plans. Understanding the role of these Marketplaces is crucial, especially when it comes to Obamacare Subsidies, which significantly lower the cost of insurance for eligible individuals.

Role of Marketplaces in the ACA

The primary role of Health Insurance Marketplaces is to offer a centralized location for consumers to shop for health insurance. These platforms provide detailed information on various plans, making it easier for individuals to compare features such as premiums, deductibles, and networks of healthcare providers. Importantly, it’s through these Marketplaces that consumers can access Obamacare Subsidies, which come in the form of Premium Tax Credits and Cost Sharing Reductions.

Accessibility and User Experience

The Marketplaces are designed to be user-friendly, offering a streamlined experience for consumers. They can be accessed online, and many states have their own state-run Marketplaces. For states that do not run their own, the federal government provides a platform. The aim is to make the process of finding and purchasing health insurance as straightforward as possible, thereby encouraging more people to get insured.

Importance of Obamacare Subsidies

One of the most significant features of the Marketplaces is the availability of Obamacare Subsidies. These subsidies are financial aids provided by the government to help lower the cost of health insurance for individuals and families with low to moderate income. The subsidies are crucial in making health insurance affordable and accessible, thus fulfilling the ACA’s primary goal of expanding healthcare coverage.

Types of Plans Available

The Marketplaces offer a variety of plans categorized into four “metal” levels: Bronze, Silver, Gold, and Platinum. Each level has its own set of premiums and out-of-pocket costs, providing options for consumers based on their healthcare needs and financial capabilities. It’s worth noting that Obamacare Subsidies can be applied to any of these metal plans, further enhancing their affordability.

2. Types of Financial Assistance

The Affordable Care Act (ACA) offers more than just a platform for comparing and purchasing health insurance plans. One of its most impactful features is the provision of financial assistance to make healthcare more affordable for Americans. This financial aid comes in two primary forms: Premium Tax Credits and Cost Sharing Reductions (CSRs). Both types of assistance are accessible through Health Insurance Marketplaces and are commonly referred to as Obamacare Subsidies.

Premium Tax Credits: The Basics

Premium Tax Credits are designed to lower the monthly cost of health insurance premiums for eligible individuals and families. The amount of the credit is determined by a sliding scale based on household income and the Federal Poverty Level (FPL). The lower your income, the higher the tax credit you’re likely to receive. This form of financial assistance is particularly beneficial for those who may not have previously been able to afford health insurance.

How Premium Tax Credits Work

To receive Premium Tax Credits, you must apply through a Health Insurance Marketplace and meet certain eligibility criteria. Once approved, the credit can be applied to any of the “metal” plans (Bronze, Silver, Gold, Platinum) available in the Marketplace. You have the option to use the credit in advance to lower your monthly premiums or claim it later when filing your taxes. This flexibility allows consumers to choose the best approach based on their financial situation.

Cost Sharing Reductions (CSRs): An Overview

Cost Sharing Reductions (CSRs) are another form of Obamacare Subsidies aimed at making healthcare more affordable. Unlike Premium Tax Credits, which lower your monthly premiums, CSRs reduce your out-of-pocket expenses like deductibles, copayments, and coinsurance. These reductions make it more financially feasible to seek medical care when needed, thus improving overall health outcomes.

Eligibility and Application for CSRs

To be eligible for CSRs, you must enroll in a Silver plan through the Health Insurance Marketplace and meet specific income requirements. The Marketplace will automatically determine your eligibility for both Premium Tax Credits and CSRs when you apply for coverage. It’s worth noting that you can benefit from both types of Obamacare Subsidies simultaneously if you meet the eligibility criteria for each.

3. Eligibility Criteria for Obamacare Subsidies

Navigating the healthcare landscape can be complex, but understanding eligibility criteria for Obamacare Subsidies can significantly ease the financial burden of healthcare costs. These subsidies, available through the Health Insurance Marketplaces, are designed to make healthcare accessible and affordable. However, not everyone qualifies for this financial assistance. This section aims to clarify the key eligibility criteria for both Premium Tax Credits and Cost Sharing Reductions (CSRs).

Household Income and Federal Poverty Level (FPL)

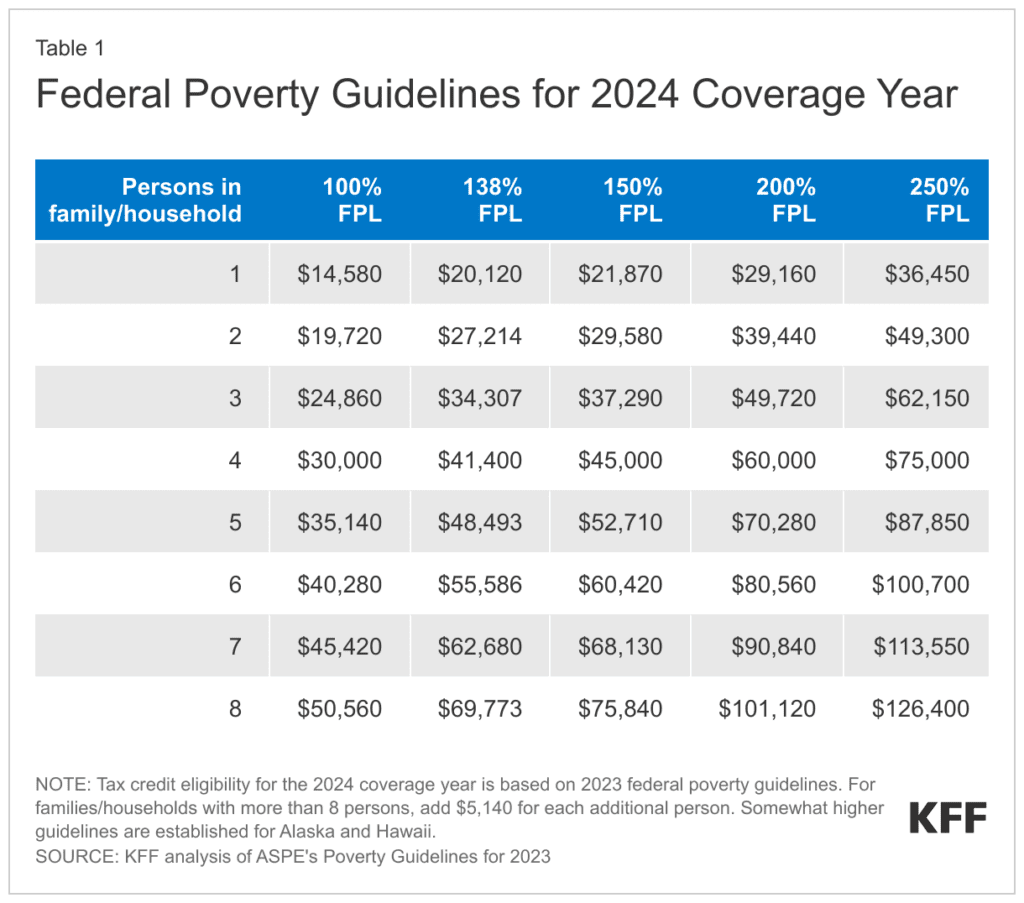

One of the primary factors determining eligibility for Obamacare Subsidies is household income in relation to the Federal Poverty Level (FPL). For Premium Tax Credits, your household income must be at least equal to the FPL. The amount of the credit is then calculated on a sliding scale based on your income. For CSRs, specific income requirements must be met, usually falling between 100% and 250% of the FPL.

Source: KFF analysis of ASPE’s Poverty Guidelines for 2023

Employment Status and Employer Coverage

Another crucial factor is your employment status and access to employer-sponsored insurance. If you have access to affordable coverage through your employer, you generally won’t be eligible for Obamacare Subsidies. The term “affordable” is defined as a premium contribution no more than 8.39% of your household income for the year 2024.

Citizenship or Legal Residency Requirements

You must also have U.S. citizenship or proof of legal residency to qualify for these subsidies. Lawfully present immigrants with a household income below 100% of the FPL can also be eligible for tax subsidies if they meet all other requirements.

Special Cases: Medicaid and CHIP

If you are eligible for other forms of government assistance like Medicaid or the Children’s Health Insurance Program (CHIP), you generally won’t qualify for Obamacare Subsidies. However, there are exceptions, particularly in states that have not expanded Medicaid under the ACA.

Marital Status and Tax Filing

Lastly, if you are married, you must file taxes jointly to be eligible for Premium Tax Credits. This is an important consideration for married couples when planning their healthcare expenses.

4. Plan Types and Choices in Health Insurance Marketplaces

When it comes to selecting a health insurance plan through the Health Insurance Marketplaces, consumers are presented with a variety of options. These plans are categorized into “metal” levels based on their cost-sharing structure, namely: Bronze, Silver, Gold, and Platinum. Additionally, there are Catastrophic plans designed for specific age groups. Understanding these different plan types is crucial for making an informed decision, especially when considering the application of Obamacare Subsidies like Premium Tax Credits and Cost Sharing Reductions (CSRs).

Understanding “Metal” Levels

The “metal” levels serve as a guide to understanding the balance between monthly premiums and out-of-pocket costs for each plan. Here’s a brief overview:

- Bronze Plans: These have the lowest monthly premiums but the highest out-of-pocket costs. They are suitable for those who expect minimal medical expenses.

- Silver Plans: These plans offer a moderate balance between premiums and out-of-pocket costs. They are the only plans that can utilize both Premium Tax Credits and CSRs.

- Gold Plans: With higher monthly premiums but lower out-of-pocket costs, these plans are ideal for those who expect frequent medical expenses.

- Platinum Plans: These have the highest monthly premiums but offer the lowest out-of-pocket costs. They are designed for those who expect significant medical expenses and want more cost predictability.

Catastrophic Plans: A Special Category

Catastrophic plans are designed primarily for individuals under the age of 30. They offer low premiums but high out-of-pocket costs, similar to Bronze plans. However, these plans are not eligible for Obamacare Subsidies, making them less appealing for those who qualify for financial assistance.

Applying Obamacare Subsidies to “Metal” Plans

One of the key advantages of Obamacare Subsidies is their flexibility in application across different “metal” levels. Premium Tax Credits can be applied to any Bronze, Silver, Gold, or Platinum plan, allowing consumers to choose a plan that best suits their healthcare needs and financial situation. However, to benefit from CSRs, you must enroll in a Silver plan.

5. Calculating the Amount of Premium Tax Credit

One of the most critical aspects of Obamacare Subsidies is understanding how the amount of the Premium Tax Credit is calculated. This financial assistance can significantly reduce the cost of health insurance premiums, but the amount varies based on several factors. This section aims to demystify the calculation process, providing a clear guide on what to expect when applying for this subsidy.

Sliding Income Scale and Its Impact

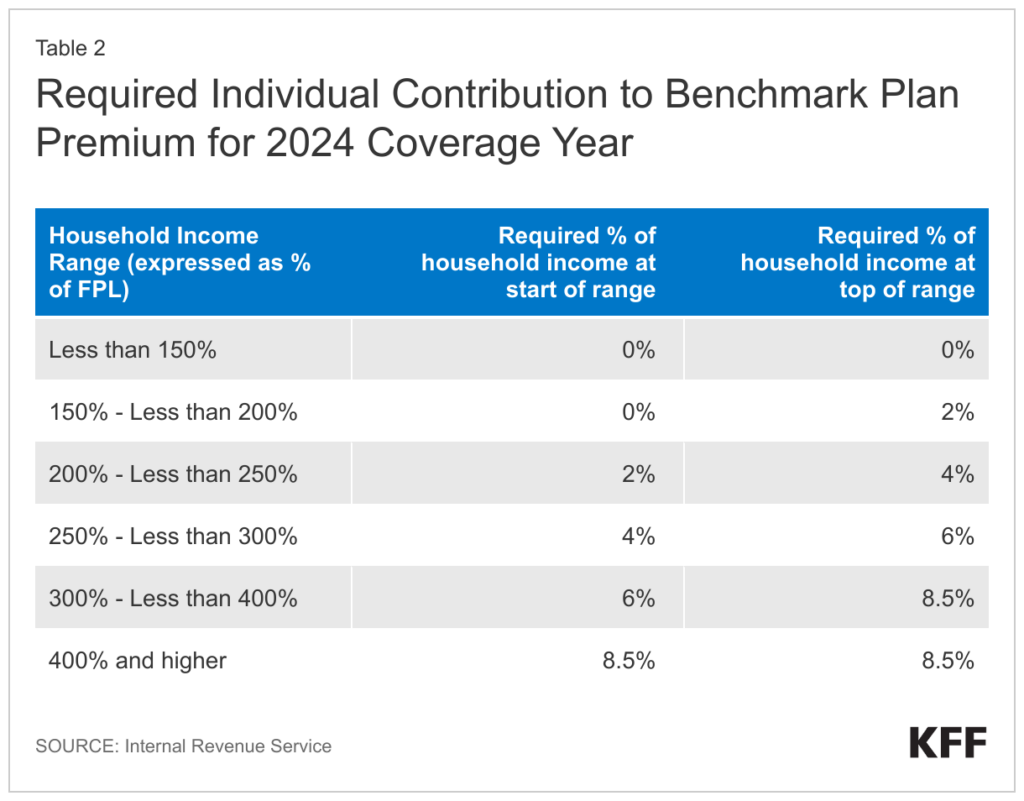

The amount of the Premium Tax Credit is determined by a sliding income scale based on the Federal Poverty Level (FPL). In essence, the lower your household income relative to the FPL, the higher the tax credit you’re likely to receive. For 2024, the required contribution ranges from zero for individuals with income up to 150% of the FPL to 8.5% of household income for those with income at 400% of the FPL or above.

Source: Internal Revenue Service

The “Benchmark” Plan

The Premium Tax Credit is calculated using a “benchmark” plan, which is the second-lowest cost Silver plan available in your area. The amount of the tax credit is the difference between the cost of this benchmark plan and your calculated “required individual contribution” based on your income.

Real-World Examples

For instance, if the benchmark plan costs $6,000 annually and your required contribution based on an income of 150% FPL is zero, your Premium Tax Credit would be $6,000. On the other hand, if your income is at 250% FPL (or $36,450 in 2024), your required contribution would be 4% of $36,450, or $1,458. In this case, your Premium Tax Credit would be $4,542 ($6,000 – $1,458).

Flexibility in Application

One of the standout features of the Premium Tax Credit is its flexibility in application across different plans. While the credit amount is based on the benchmark plan, you can apply this credit to any of the metal plans (Bronze, Silver, Gold, Platinum) available in the Marketplace. If you choose a more expensive plan, you’ll pay the difference. If you opt for a cheaper plan, the credit could cover a larger share or even the entire premium.

6. How to Receive the Premium Tax Credit

After understanding the types of plans available and how the Premium Tax Credit is calculated, the next logical step is to explore how to actually receive this financial assistance. The process involves a few key steps, from application to reconciliation, and offers some flexibility in how the credit is received. This section aims to guide you through these steps, ensuring you can make the most of the Premium Tax Credit.

The Application Process

The first step to receiving the Premium Tax Credit is to apply for coverage through the Health Insurance Marketplace. During the application, you’ll be required to provide information such as your age, address, household size, citizenship status, and estimated income for the coming year. Based on this information, the Marketplace will determine your eligibility for the credit.

Determination and Options

After submitting your application, you’ll receive a determination letter outlining the amount of the Premium Tax Credit for which you qualify. At this point, you have several options:

- Advance Payment of the Premium Tax Credit (APTC): This option allows you to have a portion of your tax credit paid directly to your insurance provider each month, reducing your monthly premium.

- Claim it Later: You can choose to pay the full premium amount yourself and then claim the entire credit when you file your tax return.

- Combination of Both: Some people opt for a combination of these two options based on their financial situation.

Source: Internal Revenue Service

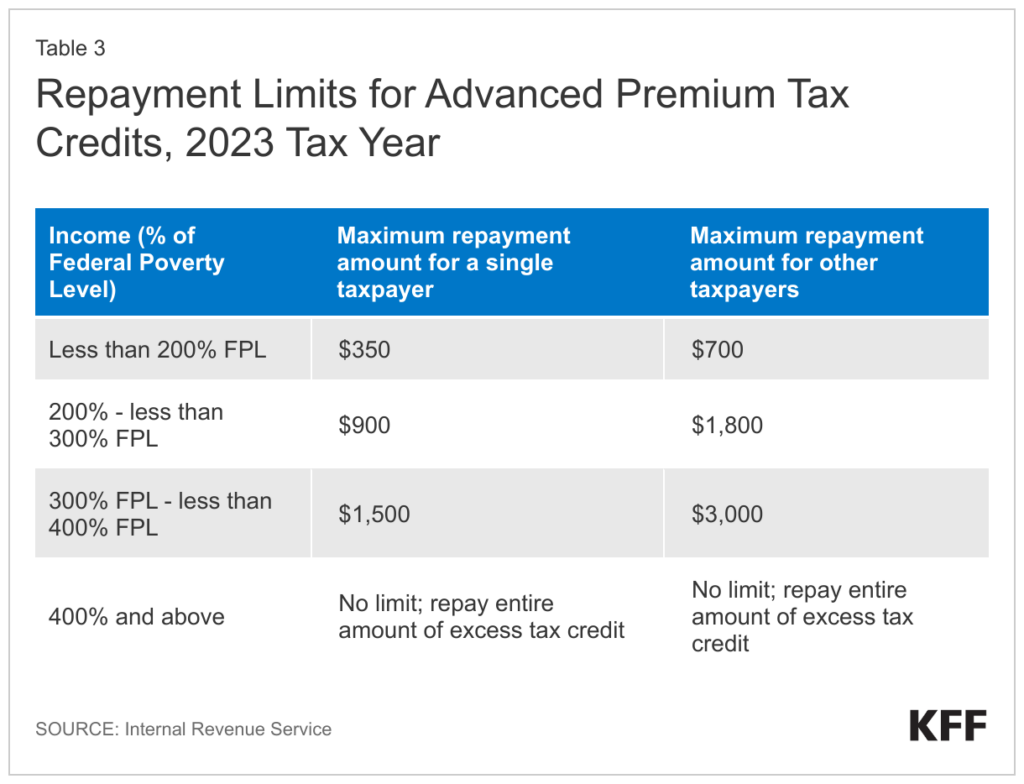

Reconciliation Process

If you choose the APTC option, you’ll need to reconcile the amount on your tax return the following year. This is because the advance payment is based on an estimate of your income, and the actual credit amount could vary based on your actual income for the year. If there’s a discrepancy, you may either receive a refund or be required to pay back some or all of the advance payment.

7. Special Considerations and Exceptions

While the general guidelines for Obamacare Subsidies like the Premium Tax Credit are fairly straightforward, there are special considerations and exceptions that can affect eligibility and the amount of financial assistance received. This section aims to shed light on these nuances, helping you navigate the complexities of the ACA with greater ease.

Special Cases: Lawfully Present Immigrants

One notable exception to the general eligibility criteria involves lawfully present immigrants. Those whose household income is below 100% of the Federal Poverty Level (FPL) can still be eligible for tax subsidies if they meet all other requirements. This exception addresses the limitations these individuals face in accessing Medicaid.

Employer Coverage Nuances

While having access to employer-sponsored insurance generally disqualifies you from receiving Obamacare Subsidies, there are exceptions. If the employer’s plan does not meet the “minimum value standard” or if the cost of coverage exceeds 8.39% of household income, you may still qualify for financial assistance through the Marketplace.

Medicaid Expansion States vs. Non-Expansion States

Your eligibility for subsidies can also be affected by whether your state has expanded Medicaid under the ACA. In Medicaid expansion states, adults with income up to 138% of the FPL are generally eligible for Medicaid and therefore not for Marketplace subsidies. In non-expansion states, the threshold is 100% of the FPL, creating a coverage gap for those with lower incomes.

Tobacco Surcharge

If you are a smoker, be aware that the Premium Tax Credit cannot be applied to the tobacco surcharge that many plans include. This means that smokers may face higher out-of-pocket costs for premiums, even with the financial assistance.

8. Frequently Asked Questions (FAQs) About Obamacare Subsidies

In the journey to understand Obamacare Subsidies, several questions often arise. This section aims to address some of the most frequently asked questions about the Premium Tax Credit and Cost Sharing Reductions (CSRs), providing quick yet comprehensive answers to common queries.

1. Can I Receive Both Premium Tax Credits and CSRs?

Yes, you can benefit from both types of Obamacare Subsidies simultaneously if you meet the eligibility criteria for each. However, to be eligible for CSRs, you must enroll in a Silver plan.

2. What Happens If My Income Changes During the Year?

If your income changes, it’s crucial to update your information in the Health Insurance Marketplace as soon as possible. This will ensure that your Premium Tax Credit amount is adjusted accordingly, minimizing the need for reconciliation at tax time.

3. Can I Opt for a More Expensive Plan and Still Receive a Credit?

Yes, you can choose a more expensive plan, but you’ll be responsible for paying the difference between the credit amount and the actual cost of the chosen plan.

4. Are Obamacare Subsidies Available in Every State?

Obamacare Subsidies are federally funded and available in every state. However, the availability of specific plans and the impact of Medicaid expansion can vary by state.

5. What If I’m Offered Employer-Sponsored Insurance Mid-Year?

If you’re offered employer-sponsored insurance that meets affordability and minimum value standards, you will generally no longer qualify for Obamacare Subsidies. You must update your Marketplace account with this information.

Summary

In summary, our comprehensive guide has walked you through the ins and outs of Obamacare Subsidies—from understanding the Types of Financial Assistance and Eligibility Criteria, to exploring Plan Types and Choices, calculating the Premium Tax Credit, and even navigating Special Considerations and Exceptions. We’ve also answered some of the most Frequently Asked Questions to help you make well-informed decisions. If you’re looking to maximize your healthcare benefits while minimizing costs, Obamacare Subsidies could be the solution you’ve been searching for. At TMT Insurance, we’re committed to helping you navigate these options with integrity and expertise. Don’t miss out on the opportunity to make healthcare more affordable and accessible for you and your family. Contact us today to learn more.